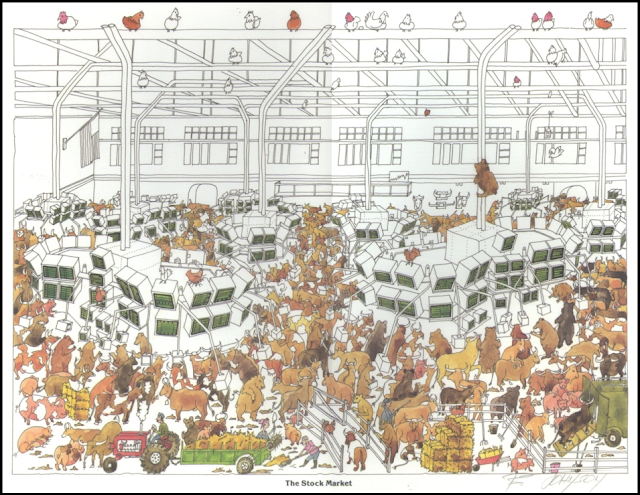

Wow. I stand here with jaw dropped and eyes wide open -- really wide. This is Thursday's (October 9th's) Industry Bell Curve. 46 out of 46 sectors tracked are in the 10% column. Astounding.

And have you ever seen anything like this NYSE chart?

Now I can imagine that this seems like a scary, unpredictable, treacherous situation to be in in the market. I can understand that the fight or flight syndrome meter is leaning way over towards the "flight" reaction. But what I see is not pending doom, but pending opportunity.

In such an oversold market, there are bound to be exceptional opportunities to buy into some very undervalued securities. Now is the time to bring out the watchlist you've been making, to revisit those picks you'd set aside for "the right time" -- it's almost upon us.

I'm not saying to go out now and take positions in every sector that's hit 10%. That would be chancy. The signals we're receiving have to be taken in context of the overall market. And the overall market is a bit unpredictable at the moment, what with the subprime debacle, the credit crisis, the bailouts -- oh, the bailouts -- and the global rush of fear.

Above is the NYSE BPI. Notice that, after a brief flirt with 40%, the index plummeted past its recent support level.

"With all this turmoil, should I give up and get out?" NO! We are in a prime position to follow Teeka's advice to let the game come to us. Opportunity is in the wings, waiting to make an entrance. When it does, for those in the game, it will be an historic occasion.

No comments:

Post a Comment